Kyc Solutions For Highvalue Goods Retailers

Click to view full size

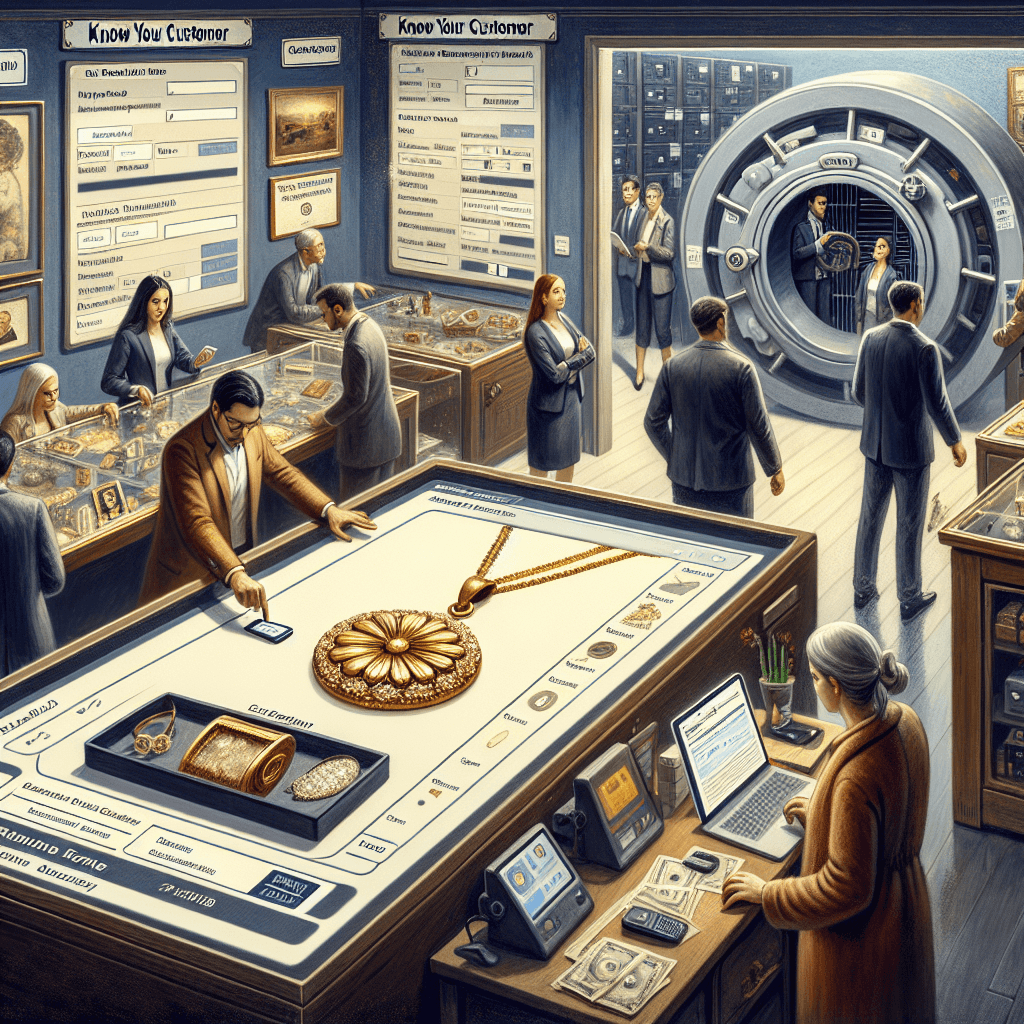

KYC Solutions for High-Value Goods Retailers

In today's market, retailers dealing in high-value goods face unique challenges, especially when it comes to maintaining compliance with regulations. Know Your Customer (KYC) solutions have become indispensable in identifying and verifying customer identities, minimizing risks of fraud, and ensuring compliance with anti-money laundering (AML) regulations. In this article, I’ll explore various KYC solutions tailor-made for high-value goods retailers, highlighting essential insights and strategies to integrate these practices seamlessly into your business model.

Understanding KYC Solutions

KYC solutions involve comprehensive processes that aid businesses in managing customer information and ensuring that their customers are who they claim to be. For high-value goods retailers — whether selling luxury fashion, jewelry, art, or high-end electronics — robust KYC practices can protect against financial losses and reputational damage.

Key Components of KYC

- Customer Identification: Verifying a customer's identity using documents such as passports or government-issued IDs.

- Customer Due Diligence (CDD): Analyzing customer profiles and transaction patterns to uncover potential risks associated with them.

- Ongoing Monitoring: Continuously assessing customer activities to detect suspicious behavior.

Why KYC is Crucial for High-Value Goods Retailers

High-value goods inherently attract various risks, including theft, fraud, and money laundering. Implementing KYC solutions helps retailers mitigate these risks significantly:

Fraud Prevention

Retailers need to ensure that purchases, both online and in-store, are made by legitimate customers. KYC practices help validate customer identities, thereby reducing fraudulent transactions.

Regulatory Compliance

Non-compliance carries severe penalties. Adhering to KYC regulations can help retailers avoid fines and legal issues by ensuring that they are fully compliant with local and international laws.

Trust Building

When customers see that your business takes identity verification seriously, it builds trust. A transparent KYC process can enhance a retailer’s reputation, fostering customer loyalty and repeat business.

Effective KYC Solutions for High-Value Retailers

To maximize their impact, retailers must implement strategies that suit their specific business models. Here are several effective KYC solutions:

1. Automated Verification Systems

These systems leverage advanced technologies such as AI and machine learning to automate the KYC process, streamlining identity verification while enhancing accuracy. For example, using biometric recognition (like facial recognition technology) allows for a secure and effortless authentication process.

2. Watchlist Screening

This process involves checking customers against national and international sanction lists, politically exposed persons (PEPs), and adverse media. Using automated screening tools helps quickly identify high-risk customers, allowing retailers to take appropriate action before establishing a business relationship.

3. Enhanced Due Diligence (EDD)

For high-value transactions, it may be necessary to perform Enhanced Due Diligence. This involves conducting deeper investigations into a customer’s background, sources of wealth, and transaction behaviors, especially for customers whose activities raise risk flags.

4. Customer Education and Transparency

Educating your customers about the KYC process can foster understanding and cooperation. Transparency in how their data will be used and protected can enhance customer trust and satisfaction.

Implementing KYC Solutions: Best Practices

Adopting effective KYC solutions isn't merely a task; it requires an integrated strategy. Here are some best practices to help you successfully implement KYC processes:

- Invest in Robust Technology: Deploy software that integrates well with your existing systems, ensuring seamless data sharing and compliance management.

- Regularly Update Procedures: Regulations and technologies evolve, so regularly review and update your KYC processes to meet current standards.

- Train Staff on KYC Policies: Ensure that all employees understand KYC principles and the importance of maintaining customer data confidentiality.

- Engage Legal Experts: Collaborate with legal advisors to ensure your KYC processes comply with local and international laws.

Conclusion

In conclusion, effective KYC solutions for high-value goods retailers are essential in safeguarding against fraud, ensuring compliance, and building customer trust. By implementing sophisticated verification processes and technologies, retailers can not only mitigate risks but also create a secure shopping environment. Prioritizing KYC practices will ultimately enhance your brand's reputation in the competitive market of high-value goods.

For further reading and resources on KYC practices, you might find the following links helpful:

- Financial Action Task Force (FATF) - Guidance on AML/CFT

- LexisNexis Risk Solutions - KYC Best Practices

By adopting comprehensive KYC strategies, you’ll position your business for sustainable success while ensuring customer security and compliance.