Canadian fintech South African customer verification: fast, compliant KYC

Canadian fintech South African customer verification: fast, compliant KYC

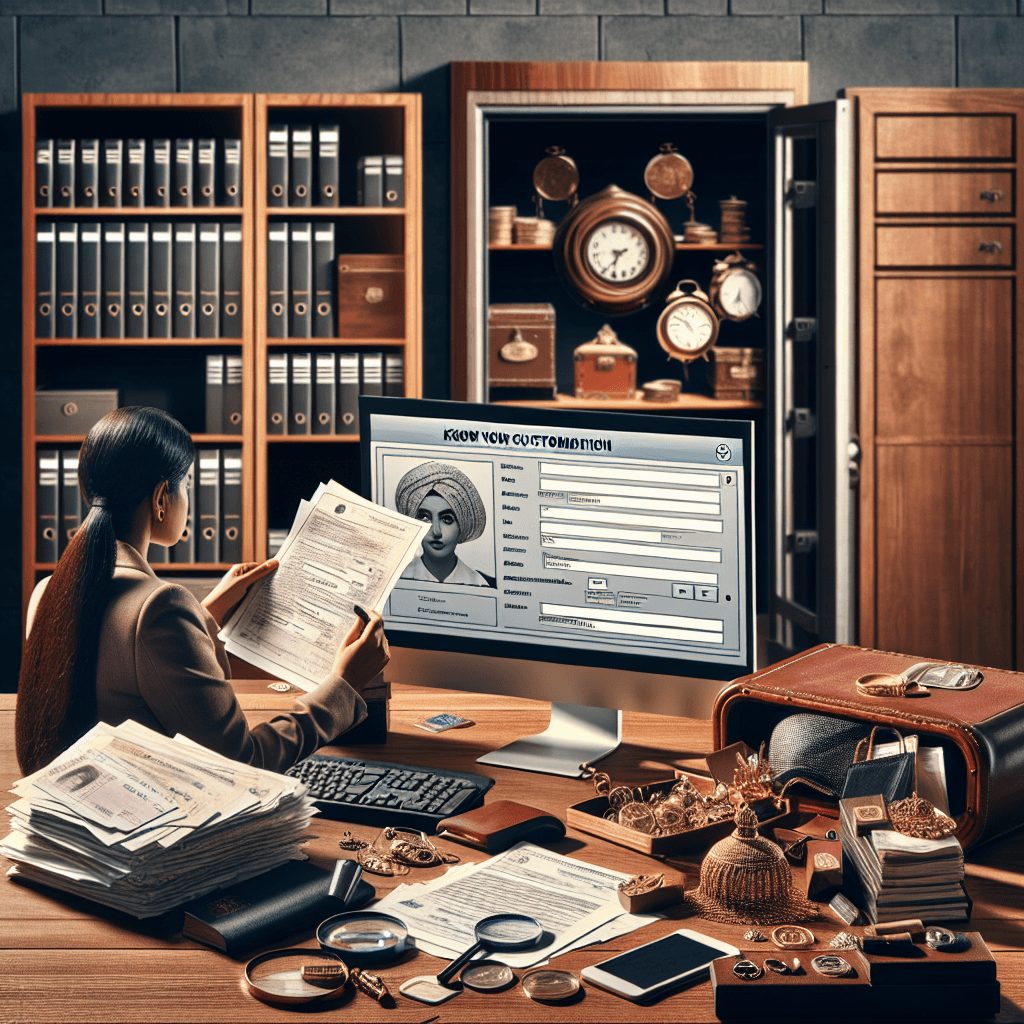

Canadian fintech South African customer verification shouldn’t slow down onboarding. With VerifyNow, you can run FICA-aligned KYC and Cross-Border KYC & International Verification checks on South African customers—remotely, securely, and at scale.

Why Canadian fintechs need South African verification (and why it’s different)

If you’re a Canadian fintech serving South Africans—whether you offer remittances, wallets, lending, crypto on-ramps, or B2B SaaS—you’re operating in a high-trust, high-scrutiny environment. Your compliance team needs to satisfy:

- Canadian AML/ATF expectations (risk-based customer due diligence, ongoing monitoring, recordkeeping)

- South African requirements like FICA (customer identification and verification standards)

- Data protection expectations under POPIA (privacy, security safeguards, breach reporting duties)

The tricky part: South Africa’s identity ecosystem is unique. Customers may present different document types, address proof can be inconsistent, and fraud patterns often look different to what Canadian teams are used to.

Important compliance note

Cross-border onboarding doesn’t reduce your obligations. If you serve South African customers, you still need robust KYC, AML screening, and privacy controls—even when verification happens entirely online.

Bold reality check: “Remote” does not mean “light-touch”

To onboard South Africans from Canada, you need a workflow that supports:

- Real-time verification of SA identity documents

- Fraud controls (tamper detection, repeat attempts, device signals where applicable)

- Audit-ready evidence for regulators and banking partners

- POPIA-aligned consent and retention practices

Using VerifyNow’s platform lets you build that workflow without turning onboarding into a manual back-and-forth.

Cross-Border KYC & International Verification: what “good” looks like

A strong cross-border KYC programme is more than “collect ID and hope for the best.” It’s a repeatable system that ties identity, risk, and compliance evidence together.

Key terms Canadian fintech teams should map early

- KYC: Know Your Customer (identity + risk-based verification)

- AML: Anti-Money Laundering (controls to prevent illicit finance)

- FICA: South Africa’s Financial Intelligence Centre Act (customer due diligence expectations)

Learn more at the Financial Intelligence Centre. - POPIA: South Africa’s privacy law (lawful processing, security safeguards, breach reporting)

Reference: popia.co.za and the Information Regulator.

A practical cross-border verification model (simple and defensible)

Here’s a structure that works well for Canadian fintech onboarding South Africans:

- Collect customer details (minimum necessary) and obtain clear consent

- Verify identity using SA document checks (real-time where possible)

- Validate contact details and risk signals (e.g., duplicates, suspicious patterns)

- Screen for AML risk where required by your programme (PEP/sanctions/adverse media as applicable)

- Decide (approve, reject, or route to manual review)

- Record evidence for audits and investigations

- Monitor (ongoing due diligence triggers, refresh cycles, unusual activity flags)

Where VerifyNow fits

With VerifyNow, Canadian teams can implement South Africa-focused identity verification remotely via API—so your product can verify customers during onboarding, not days later.

Important compliance note

Keep evidence, not just outcomes. Regulators and banking partners often want to see how you verified someone, not only that you did.

How VerifyNow enables real-time South African ID verification from Canada

Remote onboarding succeeds when it’s fast for customers and structured for compliance. VerifyNow is designed for that balance.

What you can achieve with VerifyNow’s platform

- Real-time SA ID document verification from overseas

- API-first integration for fintech apps, partner portals, and internal back-office tools

- Consistent, auditable verification results for compliance files

- Scalable onboarding for spikes in acquisition without adding headcount

Implementation checklist (for product + compliance teams)

Use this quick checklist to move from “idea” to “live”:

- Define your customer types (individuals, contractors, SMEs) and risk tiers

- Choose your verification steps (document verification, selfie/liveness if required by your policy, etc.)

- Set pass/fail rules and when to trigger manual review

- Configure data retention aligned to your legal needs and POPIA principles

- Create an audit pack template (what evidence you store per customer)

- Train operations on exception handling and escalation

Typical onboarding flows (and where they break)

Below is a practical view of what to optimise:

| Flow Stage | Common Problem | VerifyNow Fix |

|---|---|---|

| Document capture | Low-quality photos, glare, cropped edges | Clear capture requirements + real-time validation cues |

| Verification | Slow manual review queues | Automated checks for faster decisions |

| Compliance evidence | Missing logs or inconsistent files | Standardised results suitable for audits |

| Privacy | Over-collection of personal data | “Minimum necessary” workflows aligned to POPIA |

Important compliance note

POPIA requires appropriate security safeguards and accountability. If you process South African personal information, treat privacy as a core control—not a checkbox.

💡 Ready to streamline your Cross-Border KYC & International Verification compliance? Sign up for VerifyNow and start verifying IDs in seconds.

Regulatory alignment: Canada + South Africa, without the headache

Cross-border verification works best when you map obligations in both jurisdictions and implement controls that satisfy the strictest practical requirement.

South Africa: FICA + POPIA essentials you can’t ignore

FICA expectations commonly translate into:

- Identifying the customer

- Verifying identity using reliable, independent source documents/data

- Keeping records and being able to produce them when requested

Authoritative reference: Financial Intelligence Centre (FIC)

POPIA matters because you’re processing personal information. Key takeaways:

- Process lawfully and transparently

- Use minimum necessary data

- Secure data appropriately

- Respect data subject rights

- Prepare for breach reporting duties

Official references:

This year’s reality: breach reporting + enforcement risk

South African privacy enforcement has become more practical and more visible. Teams should plan for:

- Data breach reporting workflows (triage, containment, assessment, notification where required)

- Use of the POPIA eServices Portal for regulatory interactions and submissions (where applicable)

- Real financial risk: administrative fines up to ZAR 10 million under POPIA, plus reputational damage

Actionable compliance controls for Canadian fintechs

To stay defensible, implement these controls early:

- Documented risk assessment for South African customer segments

- Clear consent language and privacy notices (plain-language, accessible)

- Data minimisation: don’t collect fields you don’t use

- Role-based access to verification results and customer files

- Incident response runbook (including breach reporting decision trees)

- Vendor governance: security reviews, contracts, and audit rights

Important compliance note

“We’re based in Canada” won’t protect you if you process South African customer data. Cross-border processing still triggers POPIA responsibilities in many real-world scenarios.

Practical guide: integrating VerifyNow into a Canadian fintech stack

You don’t need a long integration cycle to go live. Most teams can implement a clean verification journey with a few deliberate steps.

Step-by-step rollout (fast, safe, scalable)

- Start in sandbox and map your onboarding journey screens

- Integrate the VerifyNow API into your onboarding flow (web or mobile)

- Store verification references (IDs, timestamps, outcomes) in your compliance datastore

- Set decision rules (auto-approve vs. manual review thresholds)

- Launch to a pilot cohort (e.g., one product line or one corridor)

- Measure drop-off + fraud and adjust capture/UX prompts

- Scale to more products, regions, and partner channels

Operational playbook (what your team needs on day one)

- A manual review queue for edge cases

- A customer support script for failed verifications (what to ask for, what not to ask for)

- A compliance escalation path for suspicious activity

- A retention schedule aligned to your legal and operational needs

- Regular quality checks on verification outcomes and false rejects

Mini FAQ: Canadian fintech South African customer verification

What documents should we verify for South African customers?

Most programmes start with South African ID verification plus supporting checks based on risk (for example, address or additional proof for higher-risk tiers). Your policy should define what’s required per tier.

Do we need FICA if we’re not based in South Africa?

You still need robust KYC and AML controls. If your business touches South African customers, partners, or regulated activities, aligning your onboarding to FICA-style evidence is often the most practical way to satisfy counterparties and reduce risk.

How do we handle POPIA when verifying customers remotely?

Build privacy into the flow:

- Collect only what you need

- Secure it properly

- Keep it only as long as necessary

- Prepare for breach reporting and regulatory engagement via the POPIA eServices Portal where relevant

References: Information Regulator and popia.co.za

How fast can we go live with VerifyNow?

If your onboarding flow is ready, you can typically implement quickly using VerifyNow’s API-first approach—then iterate based on conversion and risk outcomes.

Can VerifyNow support multinational hiring or contractor onboarding?

Yes. If you employ or contract South Africans from Canada, you still need identity verification, audit trails, and secure handling of personal information. VerifyNow supports remote verification workflows that fit HR, payroll, and contractor onboarding.

💡 Want fewer drop-offs and stronger compliance evidence? Start Your Free Trial and verify South African customers with confidence.

Get Started with VerifyNow Today

Canadian fintech South African customer verification can be fast, secure, and audit-ready—when you build it on a platform designed for South Africa’s compliance realities.

With VerifyNow, you get:

- FICA-aligned KYC workflows for South African customers

- Cross-Border KYC & International Verification built for remote onboarding

- API integration that fits modern fintech stacks

- Real-time verification with consistent, exportable compliance evidence

- Privacy-conscious processing aligned to POPIA expectations

Or explore options and packaging here: Learn More About Our Services

💡 Ready to streamline your Cross-Border KYC & International Verification compliance? Sign up for VerifyNow and start verifying IDs in seconds.

Related Articles

- Verify South African Employees In Canada Automotive Compliance Guide

- Can Verifynow Check Company Status In South Africa Ficakyc

- Addressing Fica Compliance Issues In The Automotive Industry

- How To Check Cipc Company Status In South Africa

- Internet Service Provider Compliance In South Africa A Guide For 2023

- Document Verification For Legal Processes In South Africa Verifynow

- How To Conduct Kyc In High Ticket Sales Transactions

- Digital Patient Onboarding Solutions Transforming Healthcare In South Africa

- Home Healthcare Service Compliance A Guide For South African Providers

- Fica Compliance Assessment For Motor Vehicle Dealers