Kyc Technology Solutions For Financial Services Firms

Click to view full size

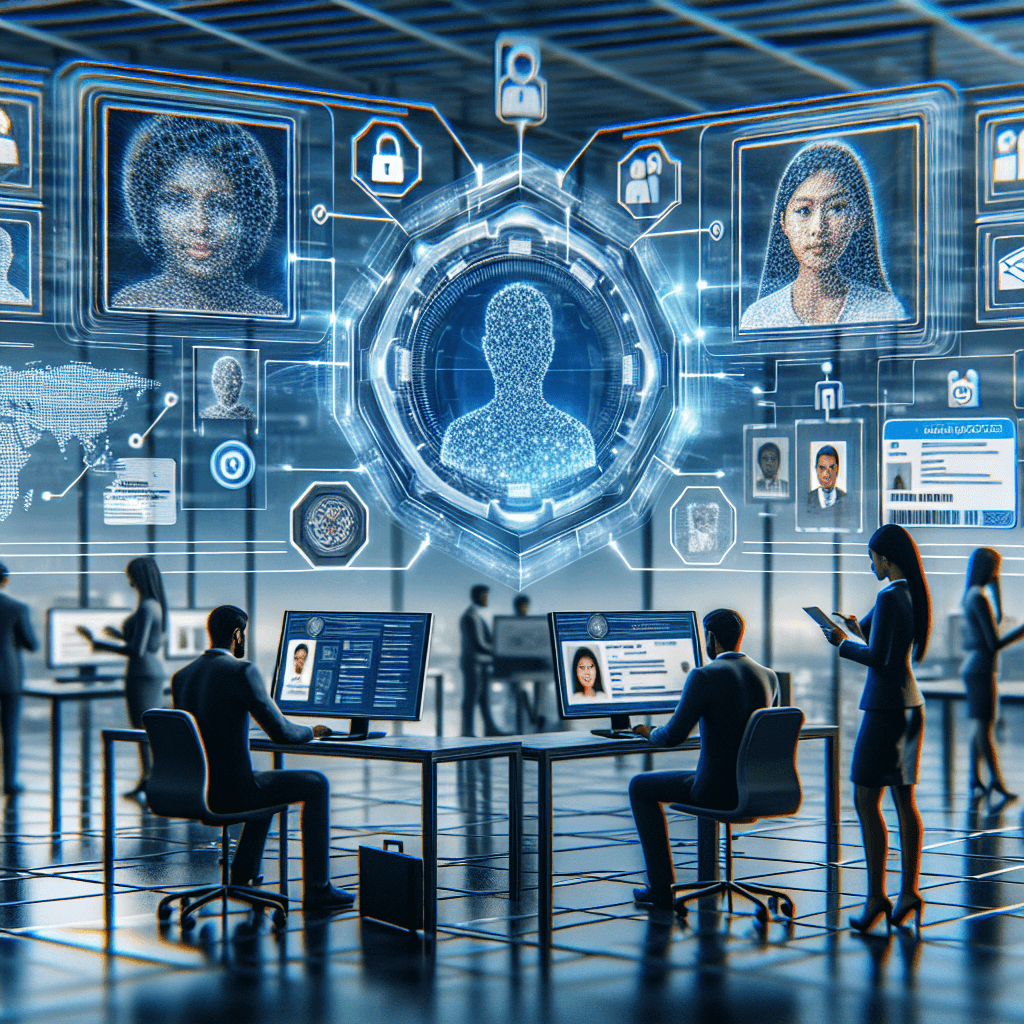

KYC Technology Solutions for Financial Services Firms

In the highly regulated world of financial services, Know Your Customer (KYC) processes play a crucial role in ensuring compliance and preventing fraud. As technology continues to evolve, innovative KYC solutions are transforming the way financial institutions manage customer identification and verification. In this blog post, I will explore various KYC technology solutions, their benefits, and how they can enhance compliance and customer experience for financial services firms.

Understanding KYC and Its Importance

KYC refers to the process financial institutions use to verify the identity of their clients. This is essential for several reasons:

- Regulatory Compliance: Governments worldwide mandate KYC to combat money laundering, terrorist financing, and fraud.

- Risk Management: KYC helps institutions identify and mitigate potential risks associated with customers.

- Customer Trust: A robust KYC process builds trust and enhances customer relationships.

As regulatory scrutiny intensifies, adopting effective KYC technology solutions becomes a strategic necessity for financial services firms.

The Role of Technology in KYC Compliance

Technological advancements have made KYC processes more efficient, accurate, and scalable. Here are some key KYC technology solutions currently shaping the landscape:

1. Digital Identity Verification

Digital identity verification tools utilize biometric authentication (such as fingerprint or facial recognition) and document verification technologies (like Optical Character Recognition or OCR) to confirm a customer's identity. These tools can:

- Reduce manual data entry and human error.

- Speed up the onboarding process, making it more user-friendly.

- Enhance security, making it difficult to forge identities.

For example, platforms like Jumio and IDnow provide comprehensive identity verification solutions tailored for the financial sector.

2. Machine Learning and AI

Artificial Intelligence (AI) and machine learning (ML) algorithms can analyze vast data sets to detect anomalies and identify potential risks associated with customer profiles. Key benefits include:

- Real-time monitoring of transactions for suspicious activity.

- Predictive analytics, identifying patterns that may indicate fraud.

- Automation of repetitive tasks, freeing compliance teams to focus on complex issues.

Companies like ComplyAdvantage leverage AI to provide real-time risk assessments and alerts.

3. Blockchain Technology

Blockchain’s decentralized nature offers secure and immutable records, significantly enhancing KYC processes. The benefits are compelling:

- Transparency and traceability of customer data.

- Single repository for KYC data, reducing redundancy and errors.

- Instant verification across institutions, simplifying the customer onboarding experience.

Organizations are exploring blockchain-based platforms for shared KYC data, particularly in cross-border transactions.

4. Regulatory Technology (RegTech)

RegTech solutions help financial firms manage regulatory compliance efficiently. Features often include:

- Automated reporting to regulatory bodies.

- Real-time compliance checks and updates on evolving regulations.

- Data analytics to ensure adherence to KYC laws.

Providers like Trulioo offer global identity verification and compliance solutions that cater to various regulatory frameworks.

Benefits of Implementing KYC Technology Solutions

Adopting KYC technology solutions offers numerous advantages for financial services firms:

- Cost Efficiency: Automation reduces operational costs and eliminates the need for extensive manual processes.

- Improved Customer Experience: Streamlined onboarding processes enhance customer satisfaction.

- Enhanced Accuracy: Technology mitigates the risk of human error, leading to more reliable data.

- Better Compliance: Automated tools help ensure adherence to regulations, reducing the risk of penalties.

For firms looking to maintain a competitive edge, investing in these technologies can yield significant returns.

Challenges in Implementing KYC Technology

While KYC technology solutions offer numerous benefits, several challenges may arise:

- Integration Issues: Merging new technologies with existing systems can be complex and time-consuming.

- Data Privacy Concerns: Ensuring compliance with data protection laws (like GDPR) is critical.

- Continuous Evolution: Staying updated with rapidly changing technology and regulations requires ongoing training and investment.

Conclusion

KYC technology solutions are revolutionizing the financial services industry by providing efficient, accurate, and secure ways to manage customer identification and verification. As regulatory demands grow, implementing digital identity verification, AI, blockchain, and regulatory technologies will not only enhance compliance but also improve customer experience. Financial services firms must embrace these advancements to maintain regulatory compliance and build trust with their clients.

By investing in the right KYC technology solutions, firms can position themselves as leaders in an increasingly competitive landscape. It's not just about compliance; it's about creating a responsive and customer-centric approach to financial services in the digital age.

For more in-depth insights and to explore specific KYC technology providers, I recommend checking out resources such as Finextra and Deloitte Insights.

Related Articles

- Fica Compliance Requirements For Independent Financial Advisors In South Africa

- Kyc Procedures For Financial Service Providers In South Africa

- Fica Compliance Guidelines For Legal Practitioners

- Understanding Fica Obligations For Motor Vehicle Dealerships

- Kyc Solutions For Highvalue Goods Retailers

- Fica Compliance Checklist For Property Practitioners

- How To Achieve Fica Compliance For South African Businesses

- Kyc Best Practices For Estate Agents In South Africa

- Fica Compliance Training For Financial Advisors In South Africa

- Fica Compliance For Real Estate Professionals In South Africa

- Role Of Kyc In Fica Compliance For Financial Service Providers

- Fica Compliance Audits For Legal Firms In South Africa

- Fica Compliance Strategies For Car Dealers

- Implementing Kyc Measures In Highvalue Goods Transactions

- Fica Compliance Documents Required For Estate Agents

- Effective Kyc Policies For South African Businesses

- Fica Compliance Software Solutions For Financial Advisors

- Understanding The Fica Compliance Framework For Motor Vehicle Dealers

- Kyc Challenges Faced By Property Practitioners In South Africa

- Fica Compliance Resources For Independent Financial Advisors

- How To Streamline Fica Compliance For Legal Practitioners

- Importance Of Kyc In Fica Compliance For Fsps

- Fica Compliance Workshops For Motor Vehicle Dealerships

- Best Kyc Practices For Highvalue Goods Dealers

- Fica Compliance Consulting Services For Estate Agents

- Enhancing Fica Compliance In South African Real Estate

- Kyc And Fica Compliance For Small Business Owners In South Africa

- Fica Compliance Requirements For Luxury Car Dealerships

- Comprehensive Kyc Solutions For Property Professionals

- Managing Fica Compliance Risks For Financial Service Providers

- Fica Compliance For Legal Practitioners In The Digital Age

- How To Conduct Kyc In Highticket Sales Transactions

- Fica Compliance Tips For Independent Financial Advisors

- Evaluating Fica Compliance Processes For South African Businesses

- Kyc Verification Methods For Estate Agents

- Fica Compliance Notifications And Updates For Car Dealers

- Best Practices For Fica Compliance In The South African Retail Industry