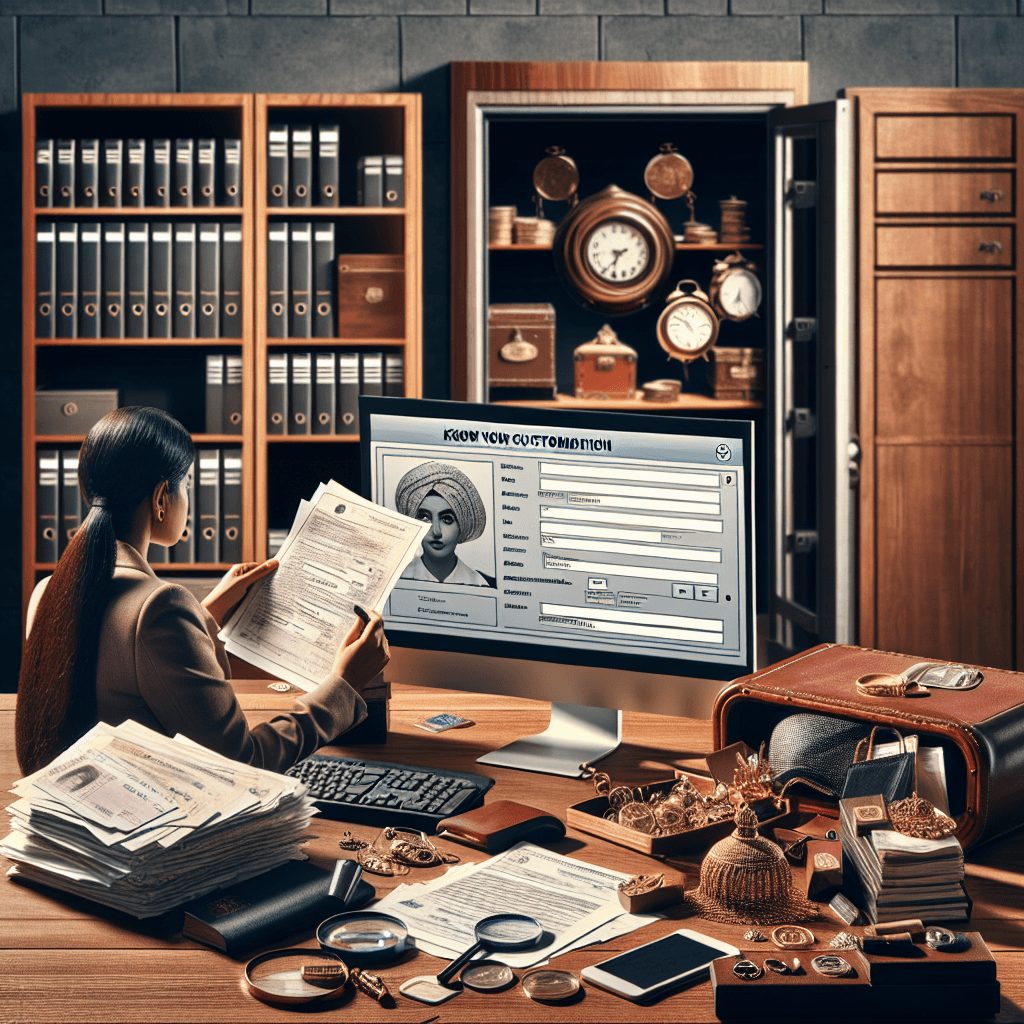

KYC Verification for South Africans from UK: A Guide for Global Businesses

KYC Verification for South Africans from UK: A Guide for Global Businesses

Navigating cross-border KYC & international verification for South African citizens when operating from the UK can seem complex. At VerifyNow, we simplify this. Learn how to meet compliance with VerifyNow's South African verification solutions.

Are you a UK-based business looking to onboard, employ, or serve South African customers or employees? You'll need robust KYC verification processes to comply with South African regulations like the FICA Act and ensure your international AML (Anti-Money Laundering) requirements are met. This is where cross-border KYC & international verification expertise becomes crucial. Understanding how to verify South African identities remotely, securely, and efficiently from overseas is key to a seamless and compliant operation.

This guide will walk you through the essentials of verifying South African identities for UK businesses, highlighting the regulatory landscape, practical implementation, and how VerifyNow can be your trusted partner in this process.

Understanding South Africa's Regulatory Landscape for KYC

South Africa has a stringent regulatory framework designed to combat financial crime and protect consumers. For UK businesses engaging with South Africans, understanding these regulations is paramount.

FICA and its Implications for International Businesses

The Financial Intelligence Centre Act (often referred to as FICA) is South Africa's primary legislation for combating money laundering and terrorist financing. It mandates that "accountable institutions" (which includes many types of businesses) must verify the identity of their clients. When you're operating from the UK and verifying a South African identity, you're essentially bridging two regulatory environments.

- Customer Due Diligence (CDD): FICA requires rigorous CDD. This means not just collecting basic information but also verifying it. For individuals, this typically involves confirming their identity, residential address, and in some cases, their source of funds.

- Risk-Based Approach: The Act promotes a risk-based approach. The level of scrutiny applied to verifying a South African identity should be proportionate to the risk of financial crime associated with that client or transaction.

- Record Keeping: FICA imposes strict record-keeping obligations. You must maintain records of the verification process for a specified period.

POPIA and Data Privacy

Beyond financial crime prevention, the Protection of Personal Information Act (POPIA) governs how personal information is processed in South Africa. This is critical for any UK business handling sensitive South African identity data.

- Lawful Processing: You must have a legal basis for processing personal information.

- Transparency: Individuals have the right to know how their data is being collected and used.

- Security Safeguards: Robust security measures are required to protect personal information from unauthorised access, loss, or disclosure.

- Data Breach Reporting: Significant changes in data breach reporting requirements have been introduced, emphasizing timely notification to the Information Regulator and affected individuals. Penalties for non-compliance can be substantial, potentially reaching ZAR 10 million.

- POPIA e-Services Portal: The Information Regulator has launched an e-services portal for easier registration and compliance management, indicating a proactive approach to POPIA enforcement.

International AML Requirements

For UK businesses, adhering to their own AML regulations is also essential. These often align with international standards set by bodies like the Financial Action Task Force (FATF). Verifying South African identities effectively contributes to meeting these broader international AML obligations.

💡 Ready to streamline your Cross-Border KYC & International Verification compliance? Sign up for VerifyNow and start verifying IDs in seconds.

Practical Implementation: Verifying South African IDs Remotely from the UK

Verifying South African identities from the UK requires a solution that is both efficient and compliant. Relying on manual processes or outdated methods can lead to delays, errors, and potential non-compliance.

The Challenge of Remote Verification

When you can't meet individuals in person, verifying the authenticity of their South African ID documents and confirming their identity becomes a significant hurdle. How do you ensure that the person you're onboarding is who they claim to be, and that their documentation is legitimate?

Leveraging Technology for Cross-Border KYC & International Verification

Modern identity verification platforms offer sophisticated solutions for remote verification. For South African identities, this means:

- Real-Time Verification of SA ID Documents: Advanced systems can capture and analyse South African ID documents (like the green barcoded ID book or the new smart ID card) in real-time. This involves checking for security features, comparing data against official sources where possible, and detecting tampering.

- Biometric Verification: Combining document verification with biometric checks (like facial recognition) can add a powerful layer of security, ensuring the person presenting the ID is physically present and matches the document's holder.

- Data Enrichment: Accessing and verifying data points from reputable South African sources (while adhering to POPIA) can further strengthen the verification process.

- API Integration for Foreign Businesses: For seamless integration into your existing workflows, robust API integration is crucial. This allows your systems to request and receive verification results instantly, without manual intervention.

Key Verification Steps for South African Identities

When implementing KYC verification for South Africans from the UK, consider the following:

- Document Capture: Secure and user-friendly capture of the South African ID document.

- Document Authentication: Automated checks for authenticity, security features, and potential fraud.

- Biometric Liveness Detection: Confirming the individual is real and present.

- Data Verification: Cross-referencing captured data against reliable sources.

- Risk Assessment: Applying a risk-based approach to the level of verification required.

FICA, POPIA, and your Verification Process

It's vital that your chosen verification method adheres to both South African FICA and POPIA regulations, as well as UK data protection laws.

- FICA Compliance: Ensure your process captures and verifies the necessary information mandated by FICA.

- POPIA Compliance: Prioritise data security, consent, and lawful processing. Understand the implications of data transfer across borders.

- Industry Authorities: Stay informed by consulting resources from relevant South African authorities such as the Financial Intelligence Centre (fic.gov.za) and the Information Regulator (inforegulator.org.za).

Important Compliance Note: Always ensure your verification partners have a clear understanding of South African regulations, including recent updates on data breach reporting and the POPIA e-services portal.

Streamlining Cross-Border KYC & International Verification with VerifyNow

Navigating the complexities of verifying South African identities from the UK doesn't have to be a headache. VerifyNow provides a comprehensive, compliant, and efficient solution designed for international businesses.

How VerifyNow Simplifies KYC Verification for South Africans

VerifyNow leverages cutting-edge technology to offer real-time verification of SA ID documents from overseas. Our platform is built with cross-border KYC & international verification in mind, ensuring that UK businesses can onboard South African clients and employees with confidence.

- Automated Document Analysis: Our system automatically analyses South African identity documents, checking for authenticity and identifying potential fraud.

- Biometric Matching: We offer robust biometric checks to ensure the individual matches the document.

- API-First Approach: Integrate our powerful API into your existing systems for a seamless, automated KYC workflow.

- Regulatory Adherence: We are committed to helping you meet your FICA and POPIA obligations, as well as international AML standards.

Implementing VerifyNow in Your Business

Integrating VerifyNow is straightforward, even for multinational companies.

- Sign Up: Get started with a free trial or explore our plans.

- Integrate: Use our intuitive API to connect VerifyNow to your onboarding or user management systems.

- Verify: Initiate verification requests for your South African users.

- Comply: Receive verified data that helps you meet your regulatory obligations.

Frequently Asked Questions (FAQs)

- Can a UK business verify a South African ID remotely?

- Yes, with the right technology and a clear understanding of South African regulations like FICA and POPIA.

- What kind of South African ID documents can be verified?

- VerifyNow supports the verification of common South African identity documents, including the green barcoded ID book and the smart ID card.

- How does VerifyNow ensure compliance with POPIA?

- We implement robust data security measures and adhere to principles of lawful data processing, helping you manage personal information responsibly.

- What are the penalties for non-compliance with POPIA?

- Penalties can be severe, including fines of up to ZAR 10 million.

🚀 Streamline your global operations and ensure robust compliance. Start Your Free Trial with VerifyNow today!

Conclusion: Secure, Compliant Cross-Border KYC & International Verification

For UK businesses operating in or with South Africa, robust KYC verification is not just a regulatory requirement; it's a cornerstone of trust and security. By understanding South Africa's FICA and POPIA frameworks and implementing effective remote verification strategies, you can mitigate risks, enhance customer trust, and ensure seamless operations.

VerifyNow is your dedicated partner in simplifying cross-border KYC & international verification. We empower businesses like yours to confidently verify South African identities, meet stringent compliance demands, and focus on growth.

Get Started with VerifyNow Today

Ready to transform your identity verification process and ensure full compliance?

- Effortless Verification: Verify South African identities in seconds from anywhere in the world.

- Regulatory Peace of Mind: Meet FICA, POPIA, and international AML requirements with confidence.

- Seamless Integration: Our powerful API connects easily with your existing systems.

- Enhanced Security: Protect your business and your customers with advanced fraud detection.

Related Articles

- Identity Verification For Cryptocurrency Exchanges A South African Perspective

- Kyc Verification For South Africans From New Zealand Your Global Compliance Guide

- Kyc Challenges Specific To Highvalue Retail Sectors

- Mining Contractor Compliance In South Africa A Comprehensive Guide

- Verify South African Id In France Cross Border Kyc Made Simple

- Vietnamese Companies Verify South African Customers With Cross Border Kyc

- Understanding The Fica Compliance Framework For Motor Vehicle Dealers

- Verify South African Id Online Dha Api Home Affairs Guide

- Verify South African Id In Rwanda Seamless Cross Border Verification

- Fraud Prevention For Online Retailers A Guide For South Africa