South African Gig Worker Verification for International Platforms (KYC)

South African Gig Worker Verification for International Platforms (KYC)

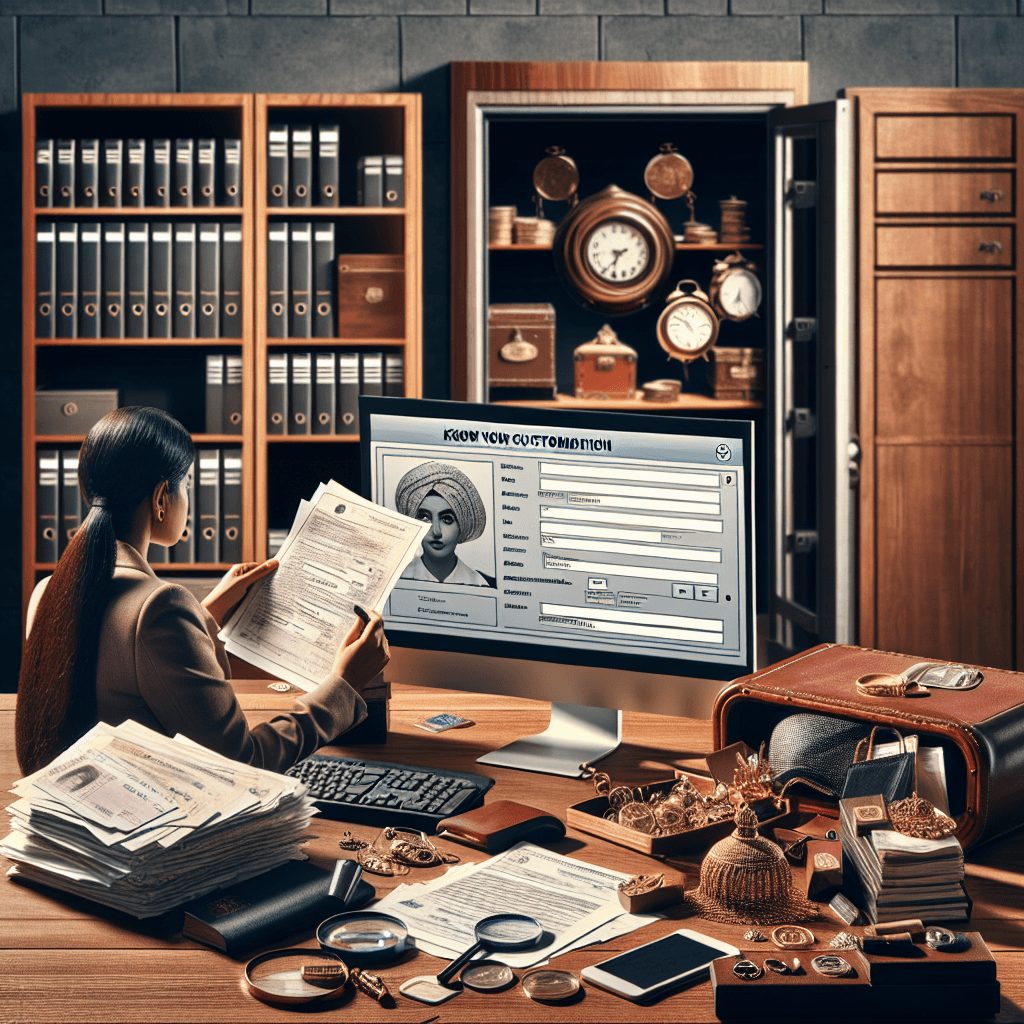

South African gig worker verification international platforms need fast, compliant, remote KYC—without friction. Using VerifyNow, you can verify South African identities from overseas in seconds while supporting FICA, AML, and POPIA obligations.

Why international platforms must verify South African gig workers

International marketplaces, staffing firms, creator platforms, and fintechs increasingly onboard South African freelancers and contractors remotely. That’s great for growth—but it also raises real compliance and fraud risks.

Here’s what typically goes wrong when cross-border onboarding isn’t designed for South Africa:

- Fake or altered ID documents submitted during remote onboarding

- Mismatched identity details (name/ID number/date of birth) across systems

- Sanctions/PEP exposure and weak AML screening controls

- POPIA gaps when collecting, storing, and transferring personal information across borders

- Slow manual reviews that frustrate legitimate gig workers and increase drop-off

VerifyNow’s platform helps international businesses confidently onboard South Africans with real-time identity checks, clear audit trails, and developer-friendly integration options via API.

Important compliance note

If you serve or pay gig workers, you’re often exposed to FICA-aligned KYC expectations (even outside SA) plus international AML requirements—especially where payments, wallets, or stored value are involved.

Key terms you need to get right (and why they matter)

- FICA: South Africa’s framework that drives customer due diligence and risk-based controls. Learn more at the Financial Intelligence Centre.

- KYC: Know Your Customer—identity verification and ongoing monitoring practices used globally.

- Cross-Border KYC & International Verification: The operational reality of verifying South African identities from another country, while meeting obligations in both jurisdictions.

- POPIA: South Africa’s privacy law, including rules on lawful processing and cross-border transfers. Reference: POPIA and the Information Regulator.

What “good” looks like for gig worker onboarding

A strong onboarding flow is:

- Remote-first (mobile friendly, low friction)

- Risk-based (more checks for higher-risk users)

- Auditable (clear logs for compliance teams)

- Privacy-led (POPIA-aligned data minimisation and security)

With VerifyNow, international platforms can implement these principles without building everything from scratch.

Cross-Border KYC & International Verification: the compliance reality

When you onboard South Africans internationally, you’re dealing with two compliance layers at once:

- South African identity and privacy expectations (FICA-aligned KYC practices + POPIA)

- Your home-country AML/KYC rules (often requiring documented customer due diligence, risk scoring, and recordkeeping)

How FICA and AML expectations show up in gig platforms

Even if you’re not a South African “accountable institution,” your risk team and banking partners may still require controls aligned to FICA and global AML norms, such as:

- Identity verification before enabling payouts

- Enhanced checks for high-risk profiles (e.g., high volumes, risky geographies, inconsistent data)

- Record retention and audit trails

- Screening for sanctions/PEP exposure (where applicable to your risk model)

Important compliance note

Your payment rails and banking partners often enforce AML/KYC standards contractually—even if your business is incorporated elsewhere.

POPIA: cross-border data transfers and breach reporting (current expectations)

POPIA is not optional if you process South African personal information. International platforms should pay special attention to:

- Lawful processing and purpose limitation

- Security safeguards (technical + organisational controls)

- Cross-border transfer conditions (ensure comparable protection and contractual safeguards)

- Breach response: POPIA requires appropriate security compromise handling and notification processes

South Africa’s privacy enforcement posture has strengthened recently, including the widely referenced risk of administrative fines up to ZAR 10 million for certain contraventions. Use official guidance via the Information Regulator and POPIA resources.

Also note: the regulator’s POPIA eServices Portal is now a practical part of how organisations engage on privacy administration and related processes. If you operate cross-border, your privacy team should align internal workflows to these channels.

Compliance checklist for multinational onboarding teams

Use this as a baseline when onboarding South African gig workers internationally:

- Documented KYC policy aligned to your AML program and risk appetite

- POPIA-compliant privacy notices and consent/contractual bases where needed

- Data retention schedule (only keep what you need, for as long as required)

- Incident response plan for data breach reporting and notifications

- Audit-ready logs for identity verification outcomes and reviewer actions

- Vendor and sub-processor controls for cross-border data sharing

How VerifyNow verifies South African identities remotely (from overseas)

International platforms need speed and confidence. VerifyNow is built for remote onboarding workflows where your teams, systems, and users are in different countries.

What you can verify with VerifyNow

With VerifyNow’s platform, you can support practical gig worker onboarding by verifying:

- South African ID details for consistency and authenticity signals

- Document capture and validation within your onboarding flow

- Real-time checks that reduce manual review queues

- Repeatable verification outcomes that support audits and investigations

Use VerifyNow’s tools to reduce:

- impersonation attempts

- duplicate accounts

- payout fraud

- compliance gaps caused by inconsistent manual checks

Implementation options for international platforms

You can deploy VerifyNow in a way that fits your product and compliance maturity:

API integration for embedded onboarding

- Best for marketplaces, fintechs, and platforms with engineering teams

- Use

APIcalls to trigger verification during signup, before payouts, or at risk events

Operations dashboard workflows for compliance teams

- Best for teams that need case management and reviewer oversight

- Helps you standardise decisions and maintain audit trails

Hybrid model

- Automate low-risk onboarding

- Escalate edge cases for review based on rules

Practical risk-based approach (recommended)

Use tiered verification so you don’t over-verify low-risk users:

| Risk Tier | Example Gig Worker Scenario | Recommended VerifyNow Flow |

|---|---|---|

| Low | New user, low payout limits | Basic ID verification + data consistency checks |

| Medium | Higher payout limits, repeat activity | ID verification + stronger validation + review triggers |

| High | Unusual behaviour, high velocity payouts | Enhanced verification + manual review + ongoing monitoring |

Important compliance note

A risk-based approach is the fastest way to improve AML outcomes while keeping onboarding conversion high.

💡 Ready to streamline your Cross-Border KYC & International Verification compliance? Sign up for VerifyNow and start verifying IDs in seconds.

Step-by-step: onboarding South African gig workers on international platforms

This is a practical, implementation-focused guide you can hand to product, compliance, and engineering teams.

Step 1: Map your regulatory obligations in both jurisdictions

Start with a simple matrix:

- What your home regulator expects (CDD/EDD, screening, recordkeeping)

- What South African law impacts (POPIA, identity handling, cross-border transfers)

- What your banking/payment partners require contractually

Authoritative references:

- Financial Intelligence Centre (FIC)

- Information Regulator

- POPIA guidance

- For global AML context, align with FATF-style principles via the Financial Action Task Force

Step 2: Design a low-friction verification journey

A conversion-friendly flow typically includes:

- Clear explanation of why verification is needed

- Mobile-first capture (most gig workers onboard on phones)

- Fast outcomes (real-time where possible)

- A retry path for honest mistakes (glare, blur, partial capture)

Use VerifyNow to keep the experience simple while still meeting KYC expectations.

Step 3: Build your decisioning rules (automation + escalation)

Decide what happens after each result:

- Pass → activate account / enable payouts

- Refer → request additional info or manual review

- Fail → block onboarding, log reasons, and provide user guidance

Keep your rules transparent and consistent, and store outcomes in an audit log.

Step 4: Align POPIA security and breach readiness

International platforms should treat POPIA like a core engineering requirement:

- Encrypt data in transit and at rest

- Restrict access by role (least privilege)

- Maintain logs for access and changes

- Prepare a breach workflow that supports data breach reporting and notification expectations

Also ensure your privacy team can operationally use the regulator’s POPIA eServices Portal processes where relevant.

Step 5: Go live with monitoring and periodic reviews

Cross-border KYC is not “set and forget.” Add:

- periodic sampling of verification outcomes

- alerts for spikes in failed checks

- reviews of false positives/false negatives

- policy updates when regulations or risk patterns shift

For a smoother rollout, start with one region or one worker category, then expand.

FAQ: South African gig worker verification for international platforms

What documents do South African gig workers typically use for KYC?

Most commonly, users rely on South African ID documentation and supporting details required by your risk model. With VerifyNow, you can structure checks to match your onboarding tier and payout risk.

Do international platforms need to follow FICA?

If you operate outside South Africa, you may not be directly regulated under FICA—but FICA-aligned controls often become necessary through:

- payment partner requirements

- AML expectations in your home jurisdiction

- internal fraud and compliance governance

Use FIC guidance to understand the local framework.

How does POPIA affect Cross-Border KYC & International Verification?

POPIA impacts:

- what you collect (data minimisation)

- how you store and secure it

- whether and how you transfer it across borders

- how you respond to security incidents

Use the Information Regulator and POPIA resources for official guidance.

What’s the risk if we get this wrong?

Risks include:

- fraud losses (payout fraud, account takeovers)

- banking partner issues (failed audits, suspended rails)

- reputational damage from poor onboarding controls

- privacy enforcement exposure, including ZAR 10 million administrative fine risk in certain cases

How quickly can we integrate VerifyNow?

Most teams can start quickly using VerifyNow’s onboarding tools, then expand into deeper API integration as needed. The best next step is to create an account and test your flow end-to-end.

💡 Want to onboard South African gig workers faster—with stronger compliance? Start Your Free Trial

Get Started with VerifyNow Today

International growth is easier when your onboarding is built for South Africa, FICA-aligned KYC, and Cross-Border KYC & International Verification from day one. VerifyNow helps you verify South African identities remotely, reduce fraud, and stay audit-ready.

Benefits of signing up:

- Real-time South African identity verification from overseas

- FICA-aligned KYC workflows that support AML programs

- POPIA-aware processes with better data handling discipline

- API-ready integration for multinational platforms

- Clear audit trails for compliance and investigations

💡 Ready to streamline your Cross-Border KYC & International Verification compliance? Sign up for VerifyNow and start verifying IDs in seconds.

For more on how VerifyNow supports your onboarding workflows, visit VerifyNow and start building a safer, faster gig worker verification journey.

Related Articles

- Navigating Fica Compliance Regulations As A Property Practitioner

- Is Verifynow Popia Compliant South Africa Kyc Fica Guide

- Document Verification For Legal Processes In South Africa Verifynow

- Fica Compliance Frameworks For Legal Services Firms

- Freight Forwarding Compliance Essential Guide For South African Logistics

- Hospitality Staff Background Checks The Key To Compliance And Trust In South Africa

- Corporate Telecommunications Compliance In South Africa A Complete Guide

- How Identity Verification Powers Cryptocurrency Exchanges In South Africa

- Credit Score Check Online In South Africa Compliance Kyc Fica Made Easy

- Digital Goods And Services Compliance In South Africa A Guide For Retail E Commerce