Verify South African ID in Dubai: Seamless Global Compliance

Verify South African ID in Dubai: Seamless Global Compliance

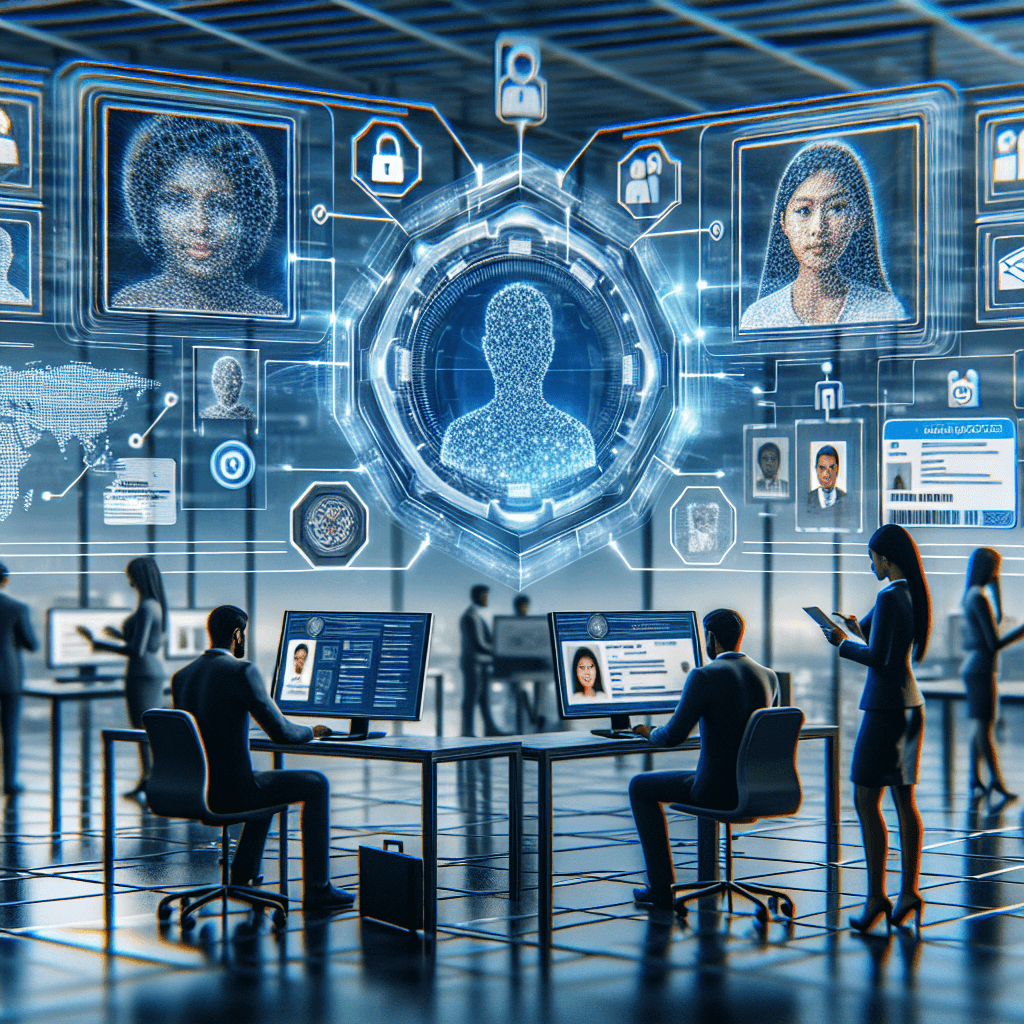

Navigating the complexities of verifying South African identities for businesses operating in Dubai has never been easier. For international enterprises, understanding and implementing robust Cross-Border KYC & International Verification processes is paramount. This guide dives deep into how you can efficiently and compliantly verify South African IDs remotely, ensuring your operations in Dubai meet stringent regulatory standards. Discover how VerifyNow.co.za empowers you to achieve this with confidence.

South Africa's robust regulatory framework, particularly the Financial Intelligence Centre Act (FICA), mandates strict Know Your Customer (KYC) procedures. When your business interacts with South African individuals, whether as customers, employees, or partners, you must adhere to these regulations, even when your operations are based in a different jurisdiction like Dubai. This isn't just about ticking boxes; it's about safeguarding your business against financial crime and building trust.

The Global Imperative: Cross-Border KYC & International Verification

In today's interconnected world, businesses are increasingly operating across borders. This presents unique challenges, especially when it comes to identity verification. For companies in Dubai looking to engage with South Africans, Cross-Border KYC & International Verification is not an option – it's a necessity.

Understanding FICA and South African Compliance

The Financial Intelligence Centre Act (FICA) is South Africa's primary legislation for combating money laundering and terrorist financing. It places significant obligations on "accountable institutions" to verify the identities of their clients and to keep records of these verifications. For businesses in Dubai, this means that if you are onboarding South African customers or employees, you are likely subject to FICA's requirements.

- Customer Due Diligence (CDD): This involves identifying and verifying the identity of your customers. For South African IDs, this typically includes verifying details from official identification documents.

- Record Keeping: FICA mandates that you keep records of the verification process for a specified period.

- Reporting Obligations: Suspicious transactions or activities must be reported to the Financial Intelligence Centre (FIC).

Failure to comply with FICA can result in severe penalties, including substantial fines and reputational damage.

International AML Requirements and Dubai's Regulatory Landscape

Dubai, as a global financial hub, has its own robust Anti-Money Laundering (AML) regulations, often aligned with international standards set by the Financial Action Task Force (FATF). These regulations complement South Africa's FICA requirements, creating a dual layer of compliance that international businesses must navigate.

- Global AML Standards: International AML regulations emphasize the importance of Know Your Customer (KYC) processes to prevent financial crimes.

- Local Dubai Regulations: Dubai's financial regulators have specific guidelines for businesses operating within the emirate, focusing on risk-based approaches to customer identification and ongoing monitoring.

When verifying South African IDs from Dubai, you need a solution that bridges these two regulatory environments, ensuring compliance with both local Dubai laws and South African FICA.

The Challenge of Remote Verification

Verifying an identity document issued in South Africa, while your business is based in Dubai, presents logistical hurdles. Traditional methods can be slow, expensive, and prone to errors. This is where advanced technology and specialized platforms become indispensable.

- Document Authenticity: Ensuring the South African ID document presented is genuine and not a forgery.

- Data Accuracy: Cross-referencing the information on the ID with other reliable sources.

- Speed and Efficiency: The need for real-time or near real-time verification to facilitate seamless onboarding processes.

Real-Time Verification of SA ID Documents from Overseas

The good news is that technology has made real-time verification of SA ID documents from overseas not only possible but also highly efficient. For businesses in Dubai, this means you can onboard South African clients or employees quickly and securely, without them needing to be physically present or sending sensitive documents through the mail.

Platforms like VerifyNow.co.za leverage sophisticated algorithms and access to verified data sources to perform these checks remotely. This capability is crucial for:

- International Hiring: Quickly verifying the identities of South African candidates for roles in Dubai.

- Financial Services: Onboarding South African clients for banking, investment, or insurance products.

- E-commerce & Gig Economy: Verifying South African users for digital platforms and services.

💡 Ready to streamline your Cross-Border KYC & International Verification compliance? Sign up for VerifyNow and start verifying IDs in seconds.

Implementing Robust Cross-Border KYC & International Verification with VerifyNow

Understanding the regulatory landscape is the first step. The next is implementing a practical, reliable solution. For businesses in Dubai seeking to verify South African ID in Dubai, VerifyNow.co.za offers a comprehensive and compliant approach.

API Integration for Foreign Businesses

For multinational companies, seamless integration into existing workflows is key. VerifyNow.co.za provides robust API integration for foreign businesses, allowing you to embed our identity verification capabilities directly into your own systems. This means:

- Automated Workflows: Trigger identity checks automatically as part of your onboarding or transaction processes.

- Scalability: Our API can handle high volumes of verification requests, scaling with your business growth.

- Customization: Integrate specific verification steps that align with your risk appetite and regulatory requirements.

How it works: Your systems send the required South African ID data to our API, and in return, you receive a clear verification status and relevant compliance reports. This drastically reduces manual effort and potential for human error.

Regulatory Compliance in Both Jurisdictions

VerifyNow.co.za is designed to help you meet the compliance demands of both South Africa and the UAE. We understand the nuances of regulatory compliance in both jurisdictions.

- FICA Compliance: Our verification processes are built to align with FICA requirements, helping you fulfill your obligations for customer due diligence and record-keeping.

- POPIA Considerations: In addition to FICA, South Africa's Protection of Personal Information Act (POPIA) governs how personal data is collected, processed, stored, and shared. VerifyNow.co.za adheres to strict data privacy standards, ensuring that the personal information of South African individuals is handled with the utmost care and in compliance with POPIA. This includes provisions for data breach reporting and the POPIA eServices Portal, which is crucial for transparency and accountability.

- UAE AML/CFT Framework: By utilizing a verified and compliant identity verification solution, you are also strengthening your adherence to the UAE's Anti-Money Laundering and Counter-Terrorist Financing (AML/CFT) regulations.

Data Breach Reporting: In the event of a data breach, both South African and UAE regulations have strict reporting requirements. Using a trusted verification partner like VerifyNow.co.za minimizes the risk of breaches and ensures that any incidents are managed according to the highest standards. Penalties for non-compliance can be significant, with potential fines reaching up to ZAR 10 million in South Africa under POPIA.

Practical Implementation Guides for Multinational Companies

We understand that implementing new compliance measures can seem daunting. VerifyNow.co.za provides comprehensive support and practical implementation guides for multinational companies looking to hire or serve South Africans.

Key Implementation Steps:

- Assessment: Understand which South African individuals your business interacts with and the level of verification required based on risk.

- Integration: Utilize our user-friendly API or direct platform access to integrate verification into your processes.

- Verification: Submit South African ID details for real-time validation.

- Record Keeping: Store verification reports securely within your system or our platform.

- Ongoing Monitoring: Implement processes for periodic re-verification if necessary.

Example Scenario: Hiring a South African Employee in Dubai

| Step | Action | VerifyNow Solution

Related Articles

- Popia Compliance For E Commerce A Guide For Real Estate Professionals

- How Long Does Verifynow Phone Trace Take In South Africa

- Dangerous Goods Transport Compliance In South Africa Stay Safe Stay Legal

- Fica Compliance Workshops For Motor Vehicle Dealerships

- Architectural Practice Compliance A Guide For South African Professionals

- Car Rental Compliance Requirements What You Need To Know In South Africa

- Future Trends In Fica Compliance For South African Businesses

- How To Verify Bank Account In South Africa A Comprehensive Guide

- Is Verifynow Phone Trace Popia Compliant Your Guide

- How To Verify Id Documents In South Africa Using Home Affairs Api