Kyc Documentation Requirements For Highvalue Goods Dealers

Click to view full size

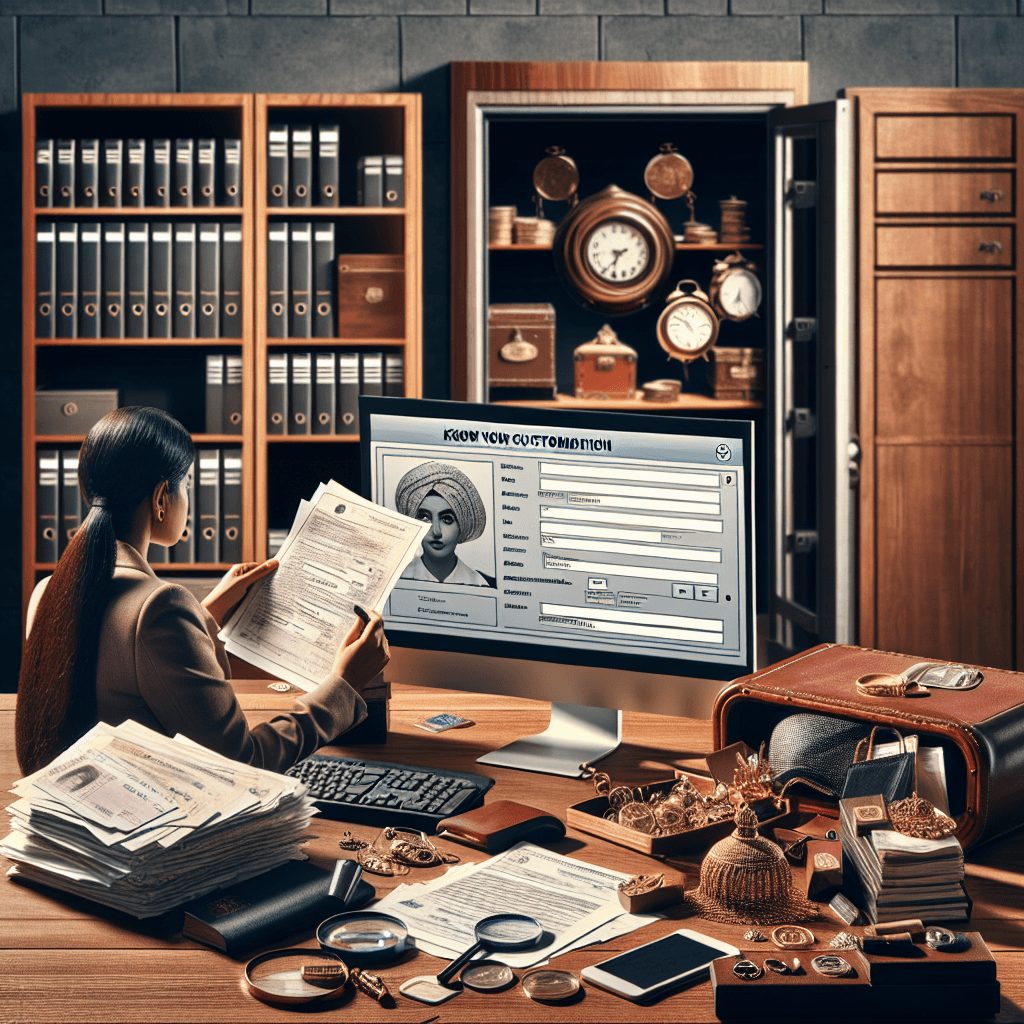

KYC Documentation Requirements for High-Value Goods Dealers

As a high-value goods dealer, ensuring compliance with Know Your Customer (KYC) regulations is critical. These rules are designed to prevent fraud, money laundering, and other illegal activities. In this blog post, I’ll provide an in-depth look at the KYC documentation requirements specific to high-value goods dealers. By understanding these requirements, you can streamline your compliance process and build trust with your customers.

What is KYC?

KYC stands for "Know Your Customer." It involves a set of procedures and documentation needed to verify the identity, suitability, and risks associated with a customer before engaging in business transactions. In the context of high-value goods, KYC is essential to ensure that the parties involved in transactions are legitimate and that the goods are originating from credible sources.

Importance of KYC for High-Value Goods Dealers

Prevent Fraud and Money Laundering: The high-value goods sector is susceptible to fraudulent transactions. Implementing strong KYC measures helps protect your business from illicit activities.

Regulatory Compliance: Many countries have stringent regulations around KYC protocols. Proper compliance helps avoid legal ramifications and potential penalties.

Building Trust: By conducting thorough KYC checks, you demonstrate commitment to ethical business practices, improving your reputation and attracting legitimate customers.

KYC Documentation Requirements

When dealing with high-value goods, it's essential to collect comprehensive documentation for KYC compliance. Listed below are key documents and information that you should gather from your customers:

1. Identification Documents

Government-Issued ID: This can include passports, national IDs, or driver's licenses. Ensure the document is unexpired and includes a clear photograph.

Secondary Identification: A utility bill, bank statement, or recent tax document can serve as a secondary verification of identity and address.

2. Business Documentation (for corporate clients)

Company Registration Documents: Including articles of incorporation or a business license showing the legitimacy of the business.

Tax Identification Number: This helps to identify the business in official tax records and ensures compliance with taxation laws.

Shareholder Information: Details about the business's major stakeholders can help identify the ultimate beneficial owners.

3. Financial Information

Bank Statements: Recent financial statements can establish the customer's financial health and source of funds.

Source of Wealth: Documentation detailing how the customer acquired their wealth. This is particularly crucial for high-value transactions.

4. Risk Assessment Information

Purpose of Transaction: Understanding why the customer seeks to purchase high-value goods can provide insight into potential risks.

Country of Operation: Given that certain countries may pose higher risks for money laundering, knowing where your customers operate is vital.

Best Practices for KYC Compliance

To ensure that your KYC processes are effective, consider the following best practices:

Stay Informed: Regulations change frequently. Stay updated on local and international KYC requirements through credible resources such as FINRA or the Financial Action Task Force (FATF).

Implement Robust Procedures: Establish a consistent KYC protocol that includes automatic risk assessment and screening tools, making the process efficient and thorough.

Train Employees: Ensure that your team understands the importance of KYC and is trained on how to collect and verify the required documents.

Maintain Record Keeping: Keep organized records of all KYC documentation for at least five years, as mandated by many jurisdictions.

Conclusion

In conclusion, understanding and adhering to KYC documentation requirements is vital for high-value goods dealers. By collecting the necessary identification, business, and financial documents, you can safeguard your business against fraud while ensuring compliance with legal regulations. Implementing best practices not only strengthens your KYC processes but also builds a foundation of trust with your customers.

If you're looking to develop or refine your KYC procedures, consider consulting with compliance experts or legal advisors to ensure that you meet local and international standards. Compliance is not just a regulatory burden; it’s a fundamental aspect of doing responsible business in today’s interconnected world.

Related Articles

- Fica Compliance Requirements For Independent Financial Advisors In South Africa

- Kyc Procedures For Financial Service Providers In South Africa

- Fica Compliance Guidelines For Legal Practitioners

- Understanding Fica Obligations For Motor Vehicle Dealerships

- Kyc Solutions For Highvalue Goods Retailers

- Fica Compliance Checklist For Property Practitioners

- How To Achieve Fica Compliance For South African Businesses

- Kyc Best Practices For Estate Agents In South Africa

- Fica Compliance Training For Financial Advisors In South Africa

- Fica Compliance For Real Estate Professionals In South Africa

- Role Of Kyc In Fica Compliance For Financial Service Providers

- Fica Compliance Audits For Legal Firms In South Africa

- Fica Compliance Strategies For Car Dealers

- Implementing Kyc Measures In Highvalue Goods Transactions

- Fica Compliance Documents Required For Estate Agents

- Effective Kyc Policies For South African Businesses

- Fica Compliance Software Solutions For Financial Advisors

- Understanding The Fica Compliance Framework For Motor Vehicle Dealers

- Kyc Challenges Faced By Property Practitioners In South Africa

- Fica Compliance Resources For Independent Financial Advisors

- How To Streamline Fica Compliance For Legal Practitioners

- Importance Of Kyc In Fica Compliance For Fsps

- Fica Compliance Workshops For Motor Vehicle Dealerships

- Best Kyc Practices For Highvalue Goods Dealers

- Fica Compliance Consulting Services For Estate Agents

- Enhancing Fica Compliance In South African Real Estate

- Kyc And Fica Compliance For Small Business Owners In South Africa

- Fica Compliance Requirements For Luxury Car Dealerships

- Comprehensive Kyc Solutions For Property Professionals

- Managing Fica Compliance Risks For Financial Service Providers

- Fica Compliance For Legal Practitioners In The Digital Age

- How To Conduct Kyc In Highticket Sales Transactions

- Fica Compliance Tips For Independent Financial Advisors

- Evaluating Fica Compliance Processes For South African Businesses

- Kyc Verification Methods For Estate Agents

- Fica Compliance Notifications And Updates For Car Dealers

- Best Practices For Fica Compliance In The South African Retail Industry

- Kyc Technology Solutions For Financial Services Firms

- Analyzing Fica Compliance Gaps For Legal Practitioners

- Fica Compliance For Online Motor Vehicle Sales

- Kyc Obligations For Highvalue Goods Dealers In South Africa

- Practical Fica Compliance Solutions For Small Businesses

- Navigating Fica Compliance Regulations As A Property Practitioner

- Kyc Best Practices Specific To South African Estate Agents

- Fica Compliance Workshops Tailored For Fsps

- Ensuring Effective Kyc Implementation In South African Businesses

- Fica Compliance Challenges For Legal Firms

- The Role Of Technology In Fica Compliance For Car Dealers

- Kyc Considerations For Highvalue Retail Transactions

- Fica Compliance Frameworks For Independent Financial Advisors

- Importance Of Continuous Training In Fica Compliance For Attorneys

- Kyc Roles And Responsibilities For Property Professionals

- Compliance With Fica Regulations For Luxury Goods Retailers

- Developing Kyc Protocols For Financial Service Practitioners

- Understanding The Link Between Kyc And Fica Compliance

- Fica Compliance Assessment For Motor Vehicle Dealers

- Strategic Kyc Approaches For Estate Agents In South Africa

- Regular Updates On Fica Compliance For Businesses

- Kyc Standards To Follow For Highvalue Goods Transactions

- Compliance Programs For Fica Regulations In South Africa

- Fica Compliance Mentorship Programs For New Financial Advisors

- Kyc Processes For Legal Practitioners In Financial Services

- Understanding Fica Compliance For Online Property Transactions

- Streamlining Kyc Processes For Luxury Car Sales

- Fica Compliance Obligations For Financial Service Providers

- Kyc And Customer Due Diligence Requirements For Estate Agents

- Addressing Fica Compliance Issues In The Automotive Industry

- Future Trends In Fica Compliance For South African Businesses